It was just a decade or so ago that the thought of starting your own business was a task too daunting for many people to take on. In recent years, opportunities to promote new products or ideas through the Internet have made the idea of starting a business less of a pipedream. But, as with most big plans, the financial aspect may still be troublesome for some would-be entrepreneurs. Not only do they need to find the capital to invest but also to choose which payment options to provide for their customers.

The capital required to successfully launch a new business depends on a variety of factors, i.e. online or brick & mortar store, product line, cost of manufacturing and employee considerations – just to name a few. The traditional plan for starting a business typically includes a substantial bank loan, but once a business is up and running, many entrepreneurs find that they need a source of credit to cover operating expenses, incidentals and emergencies.

Credit Is a Business Necessity

Credit cards serve two functions in any business – a source of readily available funds and an important payment option for their customers. To qualify for the first, the credit history of the applicant (not the business) will be reviewed to determine if there is any risk to the lender. This is why it is imperative that personal finances be well managed before starting a new business. The best credit card offers will go to those with the strongest track records and highest credit scores.

Consumers expect to be given a variety of options when paying for products and services. While cash payments aren’t going away any time soon, according to a recent Federal Reserve report, debit and credit card payments accounted for a combined total of 42 percent of consumer purchases. There’s just no way around the fact that businesses like Cvv Shop need to accept credit cards to satisfy their customers.

Choosing a Card for Business Purchases

- TOP BUSINESS OFFER

The best credit card for a new startup will have a low APR and a sufficient credit limit to accommodate your business needs. There are dozens of cards that reward cardholders, i.e. travel/airline miles, cash back, etc., but these cards tend to have higher interest rates than traditional credit cards and will cost more over time, if you carry a balance. If you don’t plan on paying off the bill in full each month, skip the rewards unless the perks are truly beneficial to your business.

It’s important to note that credit accounts opened for a business are the responsibility of the individual who opens them. Allowing the balance to get out of control or maxing out an account will reflect poorly on your personal credit reports. The most responsible way to use a business credit card is to charge only when necessary, and only in an amount that can be paid off in a reasonable amount of time.

- Providing for Your Customers

Depending on the type of business, the cost for credit card equipment varies – from a few hundred to a few thousand dollars. Banks will charge a number of initial fees to get your account set up and then ongoing monthly fees for services and support will be required.

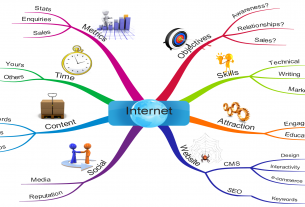

If offering traditional credit card services is out of your price range at first, there are alternatives such as Paypal and smart devices that use the Internet to process payments. Mobile device payments can be processed anywhere, opening opportunities to market your product or services on-the-go and eliminating some of the costs of traditional credit card processing services.

Credit card is a card which has a surplus of money, provided by the bank, which can be returned in the end of the month with minimal interests. This is done in order to facilitate payments till your salary day comes. Credit acts a business necessity. Other than credit cards there are other services which use the internet to make payments.